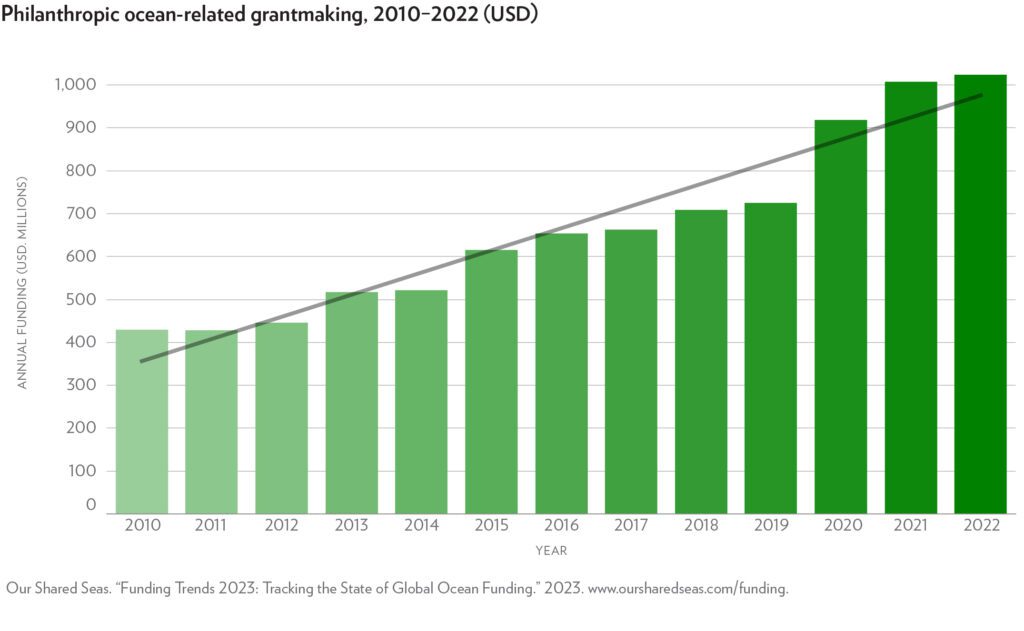

The landscape-level report, Funding Trends 2023: Tracking the State of Global Ocean Funding, presents trends on global ocean funding over the past decade-plus. The primary focus is on mapping marine conservation funding from the philanthropic sector, with this report representing the most comprehensive global analysis on the topic.

Our Shared Seas has updated this report every other year as a resource for the marine conservation sector to understand how ocean funding is evolving over time and across issues and geographies. The intention is to support shared learning and informed collaboration in the sector.

Key findings from this edition include:

- Philanthropic funding for marine conservation more than doubled over the past 13 years, from USD 430 million in 2010 to USD 1.0 billion in 2022.

- Expanded commitments from existing funders and the entrance of new funders have driven the recent increase in ocean funding.

- The top three areas of funding – Science initiatives, Fisheries and aquaculture, and Protected areas and Habitat protection – continue to reflect the core priorities of the marine conservation sector. Within these broader categories, new themes continue to emerge based on the contemporary agenda, such as efforts to increase fisheries transparency and protect 30 percent of the ocean by 2030.

- Philanthropic investment in the ocean-climate nexus is one of the most striking sectoral trends in recent years. Philanthropy and civil society have catalyzed engagement across key issues—expanding offshore wind, decarbonizing shipping, supporting coastal resilience and adaptation efforts, and more. Still, this area remains ripe with opportunity for continued investment and alignment given the ocean’s role as an essential source of ocean-climate solutions.

Due to methodological refinements, readers should reference this edition for the most recent funding trends and not compare findings across previous report editions. Readers are welcome to use all figures from this report provided that the source citation is included.

Suggested Citation:

Lewis, F., Saliman, A., Peterson, E. “Funding Trends 2023: Tracking the State of Global Ocean Funding.” Our Shared Seas. 2023.