The research shared in this guest essay, authored by Gayle Peterson, was prepared with the support of the Walton Family Foundation as part of a report series on private finance in marine conservation. Over five chapters, the pfc team—Dr. Michael Blowfield, Rares Pamfil, and Hari Balasubramanian and Gayle Peterson—analyzed 155 funds (100 non-fisheries funds and 55 fisheries funds) to understand trends, challenges, and opportunities for leveraging private capital to help sustain the ocean and global fisheries. The report— “Finance with Purpose: How Impact Investing Can Conserve the Ocean and Fisheries”—will be released in late 2021 and will be posted on the pfc website.

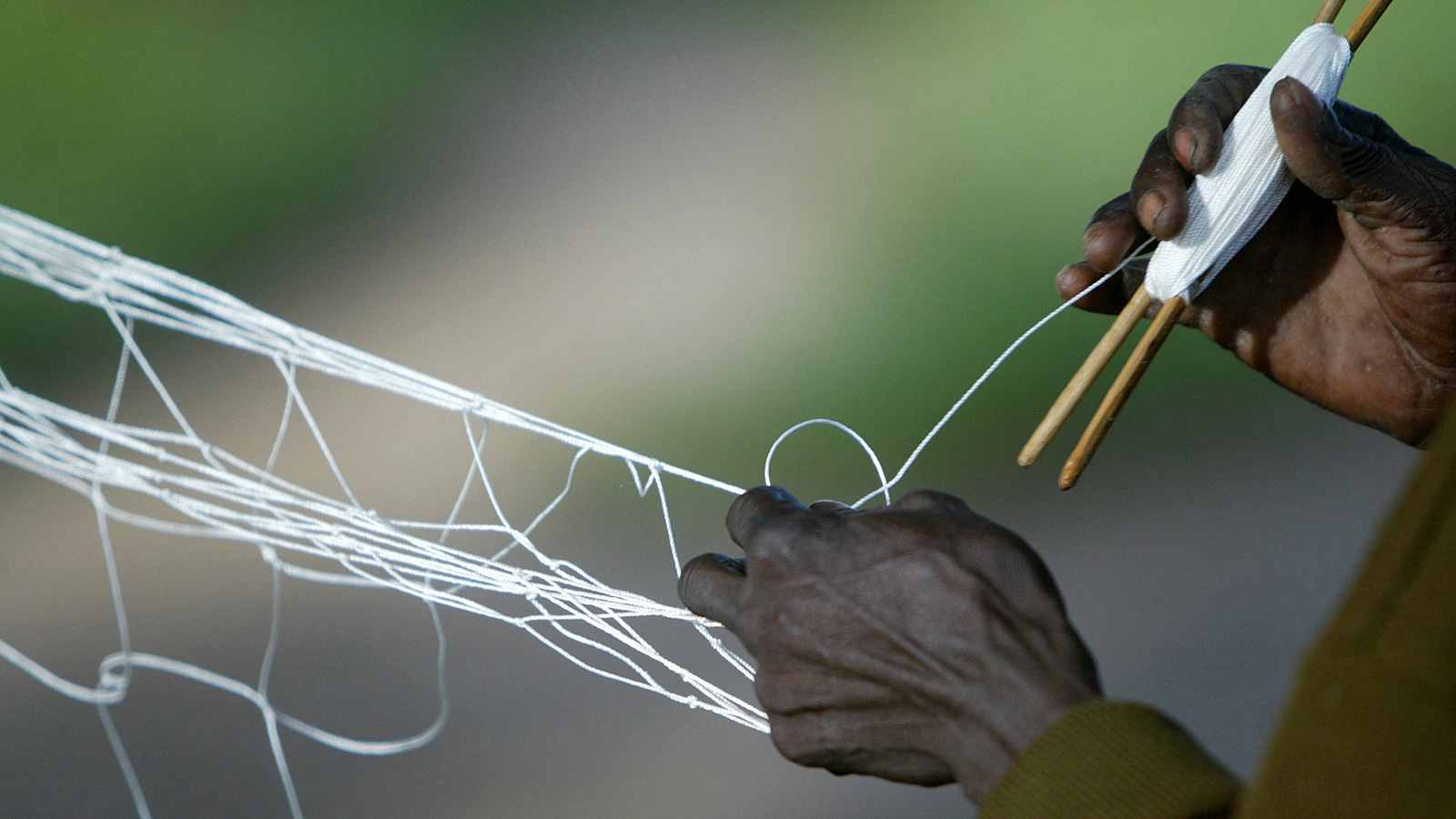

Photo: FAO

Introduction

The purpose of this essay is to better understand the current state and future of sustainable investing in the ocean and fisheries. It explores ways to help the ocean and global fisheries sector obtain increased investment to achieve sustainable ocean management. Our findings show that new investment will require a change in thinking and new cross-sectoral partnerships across private, public, philanthropic, and nonprofit sectors.

First, let’s follow the money to understand the market for sustainable investing, areas receiving the largest investment from sustainability funds, and the implications for the ocean and sustainable fisheries globally.

Second, let’s understand the evolving state of the field of sustainable ocean and fisheries investments and lessons learned. We will add context on ways the Blue Economy has contributed to investment opportunities.

Finally, we will discuss opportunities for expanding sustainable investing in the ocean and fisheries, especially in a time of “Lost in Translation.”

A Look Back, A Vision Forward

If much needed fisheries investments are to be unlocked, the wider economy and mainstream finance or private capital must be engaged. For the scope of this research, private capital includes impact investing and Environmental, Social, and Governance (ESG) investments. The report examines investments in the ocean and sustainable fisheries and aquaculture.

This report provides a look back at more than 10 years of investing by 55 sustainable funds and finds that private finance has invested an estimated USD 3.5 billion to support sustainable fisheries for wild caught and aquaculture. As of mid-year 2021, the sector is raising or investing an additional USD 1 billion in the ocean or fisheries, based on several recently-announced strategies. This analysis considers trends in fund development, size, scope, and geographic distribution.

Photo: FAO

Snapshot: Sustainable Fisheries Fund Analysis: 2008-2021

Twelve Years of Evolution

The last 12 years have seen sustainable fisheries funds evolve from grant capital to blended finance models and commercial finance. The following section identifies key trends in the field’s evolution over the past decade.

2008–2012 Milestone: Philanthropy and Concessionary Capital

The first fisheries funds were ‘impact first,’ supported by philanthropic concessionary capital with a zero-to-submarket rate of return on investments. They were often created to address dire fisheries sustainability problems in which financial support was needed for struggling small-scale fishers and where traditional capital was unavailable. Important lessons learned from these early investments included:

- Tying policy to financial incentives to support fishers requires a long-term commitment to implementation and oversight by dedicated partners. Worldwide, advocates working at the nexus of policy, livelihoods, and finance face the ongoing challenge of a lack of access to affordable capital. They also face the risk of working with unstable and unpredictable governments, whether in developed or emerging and frontier markets, making policy reform tied to financing vehicles more difficult to negotiate and sustain.

- Technical assistance is critical to help move ideas into practice and profitability.

2013–2015 Milestone: Focus on Private Investments and Blended Capital

The second wave of funds was more focused on blended capital, using philanthropic funds to attract non-concessionary investment. These were generally early-stage private investment funds mostly making investments in aquaculture. Aquaculture investments tend to be closed systems with manageable volatility and risk, akin to known asset classes on land. Investors are relatively comfortable with this style of investment and level of risk. For instance, Eco.Business Fund was formed in 2014 to promote biodiversity conservation, climate change mitigation in fisheries, forests, agriculture, and tourism in Latin America, the Caribbean, and sub-Saharan Africa. The Fund provides loans and technical assistance either to financial institutions and businesses through intermediaries or directly to businesses that promote sustainable production and consumption.

2015–2020 Milestone: Significant Increase in Innovative Ocean Finance

The last five years have seen a significant increase in ocean-oriented financing, with approximately 75 percent of the funds stablished since 2015 and a significant uptick in public and private equity interest in the sustainable ocean sector in 2020.

2020 was a seminal year as it ushered in several public and private equity funds continuing to professionalize aquaculture and industrial fisheries in the USD 100 million to USD 1 billion range.

One notable example is that Credit Suisse and Rockefeller Asset Management launched a USD 212 million Ocean Engagement Fund providing retail and institutional investors with the opportunity to support a sustainable Blue Economy. The fund focuses on three ocean themes: pollution prevention, carbon transition, and ocean conservation. As the investment advisor to the fund, Rockefeller Asset Management employs a global equity strategy investing in 30-50 stocks from a customized, high engagement ocean portfolio.

Sustainable investment funds are increasingly large and professionally managed, and they have been attracting more mainstream Limited Partnerships.

Aquaculture as a Sustainable Investment Driver

As larger investment interests shifted to ocean issues in 2015, aquaculture was the first sector to attract the attention of investors. This focus has continued through 2020. Depending on practices employed, the aquaculture sector can have negative impacts on marine ecosystems and communities—although recent research suggests that the sector has made important sustainability gains over the past decade. The aquaculture sector has received approximately 66 percent of assets under management and appears to be popular with impact investors for two main reasons:

- Aquaculture offers a strong business model that can show predictable revenue streams. It has a track record of providing financial returns that may help to attract more investment. Aquaculture also reduces investment risks by better controlling challenges in wild-caught fisheries such as corruption, governance, tenure.

- It offers measurable social and environmental impact—including fish protein to address food security, coupled with the controlled nature of aquaculture relative to wild caught fisheries.

Growth in Wild Caught Fisheries

Investing in sustainable wild caught fisheries remains challenging for the private sector. Although wild caught fisheries received only about 20 percent of assets under management in our analysis, there was some growth in this area during the 2017–2020 time period. This increase is driven in part by interest in nature-based investing and the recognition that unsustainable fishing is among the most serious threats to ocean health. Additionally, the World Economic Forum has made loss of biodiversity and climate change a focus of its annual global risks report, which has triggered additional interest from financial institutions. Due to COVID-19 impacts, there has also been a realization that support for nature-based solutions can be achieved by shifting subsidies from extraction to nature-positive practices.1

Geographic Focus

Geographically, investments in this sector tend to correlate with high fish producing and marine economy jurisdictions. Our analysis shows that Asia has been the highest recipient of private finance funding in this sector (at USD 1.4 billion), while South America has received the smallest proportion of funding (at USD 60 million) during 2008–2020.

Sustainable Ocean and Fisheries Investments, by Geography (2008–2020)

| Region | Investment |

| Africa | USD 394 million |

| Asia | USD 1.4 billion |

| Europe | USD 294 million |

| Global (cross-cutting) | USD 697 million |

| North America | USD 593 million |

| South America | USD 60 million |

Photo: FAO

Cautions

Before we celebrate the recent increases in funding for sustainable fisheries, it is important to remember a few caveats:

- These funds are not necessarily being directed where they would do the most good.

- The fisheries and ocean funds are still a fraction by global investment standards. In the mainstream capital markets, individual funds of less than a billion dollars are considered small, whereas in fisheries a fund of USD 100 million is considered large. These are also among the most neglected of the Sustainable Development Goals (SDGs).

- Larger investors often invest in companies with limited supply chain transparency, which makes their net environmental impact uncertain.

Lost in Translation

A recurring theme of our research is that diverse stakeholders face challenges in communicating with each other. Communities are wary about the relationship that intermediary organizations have with investors, while intermediaries can struggle to understand what investors want of them. At the same time, passionate impact investors are working to access larger pools of capital that are regulated and managed without sustainability priorities or directives. These communication failures are an impediment to the growth of ocean and fisheries funds.

The narrative should change from focusing on stories to understanding business models. An intermediary organization like Comunidad y Biodiversidad (COBI) in Mexico, for instance, is accustomed to fundraising from foundations through powerful storytelling about sustainability challenges. To capture the interest of different types of investors, investees need to make the financial case first and foremost so that investors keep listening long enough to learn about the social or environmental returns.

Ensuring sufficient investment in fisheries and the ocean requires building new relations: from investors to advocates to communities who may not all speak the same language or have a common vision for sustainable fisheries. Moving investment from millions to billions will require working across these diverse sectors and at the nexus of policy, education, communications, markets, community, and investment. It will require innovative ways of blending capital and a holistic perspective on communities’ complex needs. This new way of “thinking and acting” asks partners at the table to build trust, to be honest about their challenges, and to be willing to adapt. Philanthropy has a powerful opportunity to become an important navigator and translator among diverse partners and ensure a collective vision for investing in a resilient ocean, fisheries, and communities.

Photo: FAO

Actionable Ways to Increase Impact

There are several ways that various sectors—include public, private, and philanthropic sectors and civil society—can work together to increase the impact of private sector investments in the ocean and global fisheries.

1. Focus on Policy and Regulation to Leverage Investment

- Policy and regulation are underlying drivers for improvements in sustainable use of the ocean. Regulation can accelerate the transition to sustainability in financial institutions that are otherwise slow to move and lack a culture of innovation. For example, the recent Markets in Financial Instruments Directives (MiFID II) is considered a “tectonic” game-changer. MiFID II requires wealth managers to actively discover clients’ Environmental, Social, and Governance (ESG) preferences and makes it illegal to ignore them as part of investment decisions. This has led once reluctant wealth managers to engage in sustainability conversations as commonplace.

- Funds and the investment industry more generally could play a bigger part in public policy discourse. There is an appetite amongst some funds to make their voice on sustainability better heard, and the appetite for this is likely to increase because of the focus on finance in the 2021 climate change conference, COP26.

- Stock exchanges could also make regulatory improvements. For example, rules on disclosure and transparency regarding fisheries for publicly traded stocks, investment funds, and fisheries-related companies.

2. Provide Investor Education

Investors are moved by what they can see and understand, so educating investors about sustainable fisheries is essential.

- Relate fisheries to other popular areas of impact focus, such as climate change.

- Link fisheries to other well-funded instruments and markets. Getting sustainable fisheries recognized as a form of carbon offset, for instance, would allow the sector to tap into billions of dollars of funding. Other options include demonstrating that investing in fisheries has mutual benefits in areas such as healthcare and social insurance.

- Help investors develop an emotional connection to the cause.

3. Build a Diverse Investment Ecosystem

The sectors with relatively large impact investment funds, such as microfinance and clean energy, have a well-developed investment ecosystem. Such an ecosystem has the following features:

- A broad range of investors and accessible affordable investment products enabling access to capital for organizations at different stages of development (e.g., angel investing and venture capital at the start-up stage; private equity at the growth stage; private debt to scale and ability to access public markets equity and bonds at the expansion stage).

- A healthy market for buying and selling assets so that entering and exiting the market is relatively straightforward.

- Multiple types of investors (e.g., pension funds, endowments, development finance institutions, family offices).

Create products and services to assist the investment community in constructing, implementing, and managing sustainable investment strategies (e.g., sell-side research firms offering data products and services such as ESG data and ratings, portfolio analytics, controversy alerts, and engagement services).

- Involve Family Offices. They have longer time horizons than many investors because of their mandate to preserve wealth across generations.

- Family offices are far more nimble than institutional investors, pension funds or trusts which have more restrictions on how capital is used.

- Family offices are eager to integrate family values into their investment approach, either because younger generations are reflecting on the purpose of money, or because older generations are concerned with their legacy.

4. Focus on Impact Investing Nuts and Bolts

A fund’s sustainability intent should be captured in its impact thesis which articulates the improvement in outcomes that the investor intends to achieve and how the investment will contribute to that improvement. Without this, investors struggle to distinguish between “true impact” and “greenwashing” or “impact-washing.”

Large investment funds continue to develop their own processes as a unique selling point, and more generic impact tools are also emerging. For instance, in 2020 a consortium of asset managers launched the Sustainable Development Investments Asset Owner Platform (SDI AOP), which enables investors to assess companies on their contributions to the Sustainable Development Goals.

More work is needed to strengthen relationships between funders, intermediaries, and communities. The following challenges for fisheries deserve particular attention:

- The scarcity of philanthropic resources can foster counterproductive competition between NGOs.

- Communities and intermediaries tend to distrust large funds.

- Neglecting other aspects of fishers’ lives can impede sustainability efforts. Fishers may drift away from sustainability initiatives if other essential needs—for housing, education, or medical care—are not being met. Blended capital investments from private, public, and philanthropic sources are a way of creating multi-layered community-wide investments to provide the necessary support.

Gayle Peterson is founder and managing director of pfc social impact advisors (pfc) and programme director of Impact Investing and Social Finance Programmes at Said Business School, Oxford University.

Notes

- Dasgupta, P. The Economics of Biodiversity: The Dasgupta Review. Abridged Version. London, HM Treasury, 2021.